Nvidia Takes Intel’s Place in the Dow Jones Industrial Average

Nvidia has officially replaced Intel in the Dow Jones Industrial Average, marking the end of Intel’s 25-year tenure in this prestigious index.

This significant shift in the 128-year-old stock index follows the recent inclusion of Amazon, which took the spot of Walgreens earlier this year.

The transition occurred Friday morning, prior to the opening of US markets, with S&P Global stating it was made to enhance representation of the semiconductor sector.

This development is a notable setback for Intel, which became the first technology company to join the Dow alongside Microsoft in 1999, signaling a turning point for the veteran semiconductor manufacturer.

Founded in 1968, Intel played a pivotal role in establishing Silicon Valley by designing and producing microchips essential for the explosive growth of the computer industry. Its dynamic random-access memory (DRAM) chip, introduced in 1970, was the first capable of storing substantial amounts of data.

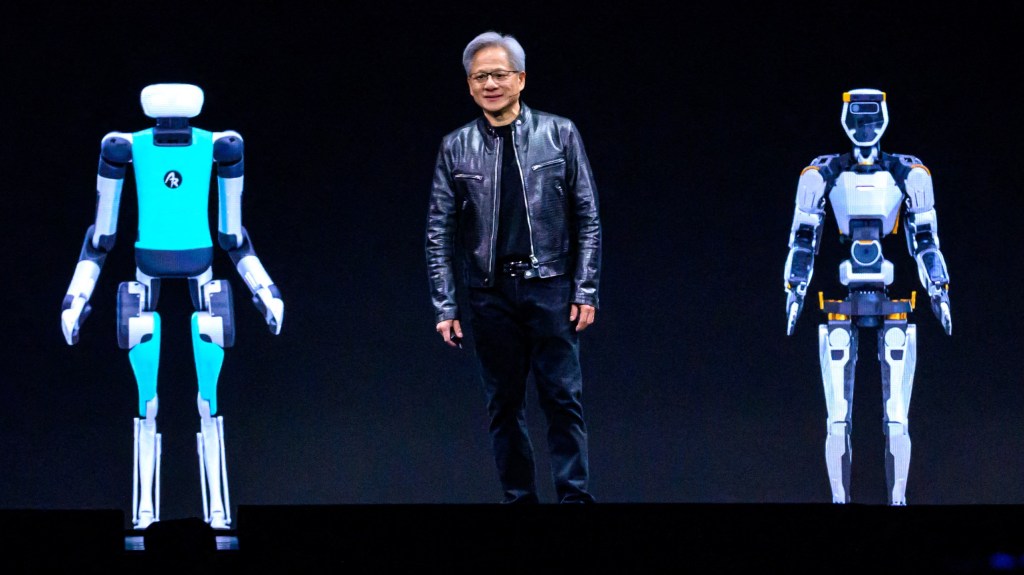

Nvidia, a younger competitor established in 1993, has experienced explosive growth, with its share prices surging 220% over the past year. The company’s graphics processing units (GPUs) are now in high demand, largely due to their applications in artificial intelligence.

As artificial intelligence continues to expand, Nvidia has seen a significant increase in GPU demand. During Q2, the company reported sales reaching $30 billion, a 15% quarter-over-quarter increase and a remarkable 122% increase year-over-year.

Intel, on the other hand, missed crucial opportunities in the mobile sector with the rise of smartphones, where Arm has taken a commanding lead. Reports from The New York Times indicate that in 2005, Intel opted against acquiring Nvidia and also missed an early chance to invest in OpenAI.

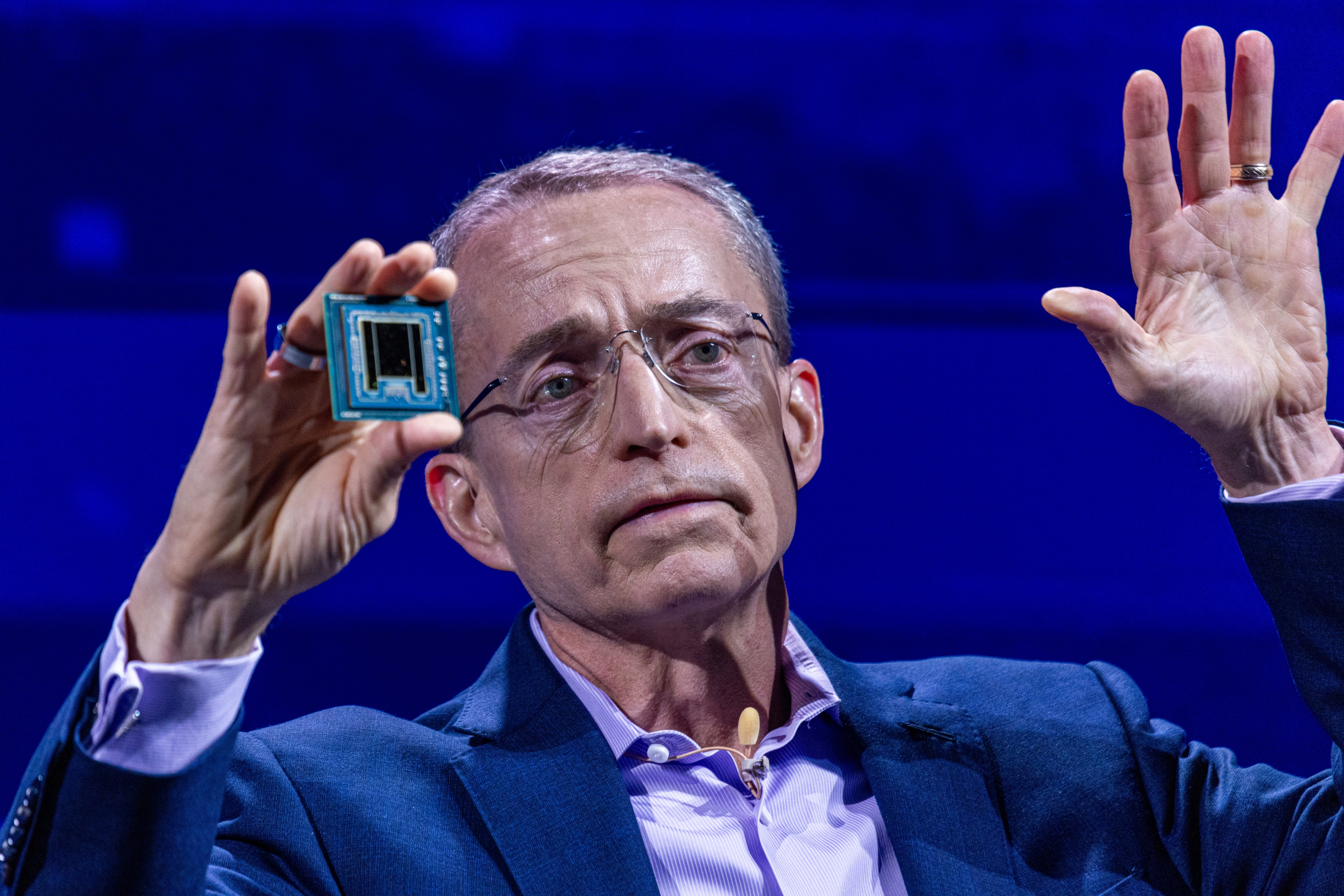

In stark contrast to Nvidia’s rapid ascent, Intel’s stock has plummeted over 30% in the past year, landing at approximately $26. In its third-quarter report, Intel revealed revenues of $13.3 billion, representing a 6% decline from the same quarter last year. Under the leadership of CEO Pat Gelsinger, the company is currently undergoing a strategic overhaul.

Unlike Intel, Nvidia does not manufacture its own chips but outsources production to Taiwan Semiconductor Manufacturing Company, a significant competitor of Intel.

The replacement of Intel by Nvidia in the Dow Jones serves largely a symbolic purpose, as investors typically track the S&P 500 index rather than the Dow.

The Dow was initiated in 1896 by Charles Dow, who began calculating the daily average of 12 major stocks, which expanded to 30 by 1928, establishing it as a key market benchmark.

The selection of companies for the index is done by a committee based on their perceived impact on the US economy, with share price being a critical factor for inclusion.

Changes to the index occur on an “as-needed basis,” with S&P Global noting, “To preserve continuity, changes are rare. Replacing a stock typically requires a significant alteration in the core business of a constituent company or a major corporate event, like an acquisition.”

Alongside Nvidia, Sherwin-Williams, a manufacturer of paints, will also join the index, replacing Dow Inc., a producer of commodity chemicals, though the two are unrelated.

Interestingly, due to the index being weighted by stock price instead of market value, Sherwin-Williams, priced around $387, will comprise a larger proportion of the Dow compared to Nvidia, whose shares are valued at about $148. Nvidia boasts a market capitalization of $3.6 trillion, while Sherwin-Williams sits at $97.6 billion.

Post Comment